What is a Credit Score?

Your credit score is a numerical representation of your creditworthiness, which indicates how likely you are to repay borrowed money. Lenders, landlords, and even insurance companies often use your credit score to assess the risk of lending to you or doing business with you. A higher score generally signifies lower risk and vice versa.

Credit scores are calculated by credit bureaus based on your credit history, which includes your borrowing and repayment patterns. There are several scoring models used, but the most commonly known is the FICO score, which ranges from 300 to 850.

The Components of a Credit Score

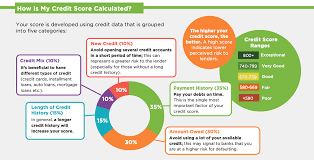

A credit score is made up of five key components, each contributing a different percentage to your overall score:

- Payment History (35%): This is the most significant factor in your score. It tracks whether you’ve paid your bills on time, including credit cards, loans, and mortgages. Late payments, defaults, or bankruptcies can significantly hurt your score.

- Credit Utilization (30%): This refers to the ratio of your credit card balances to your credit limits. Ideally, you should use less than 30% of your available credit to avoid negatively impacting your score.

- Length of Credit History (15%): The longer your credit history, the better it is for your score. Lenders like to see that you’ve managed credit responsibly over time.

- Credit Mix (10%): Having a variety of credit types, such as credit cards, installment loans, and mortgages, can positively affect your score, showing that you can manage different forms of credit.

- New Credit (10%): Every time you apply for new credit, a hard inquiry is made, which can temporarily lower your score. Opening too many new accounts in a short period may signal financial distress and negatively affect your score.

The Impact of Your Credit Score

A good credit score can make a huge difference in your financial life, impacting several important areas:

How Your Credit Score Affects Loan Approvals

Lenders use your credit score to determine whether they will approve your loan application. If your score is high, it indicates that you are likely to repay the loan, making lenders more inclined to approve your application. Conversely, a low score suggests higher risk, and you may be denied credit or face more stringent approval conditions.

Influence on Interest Rates

Even if you are approved for a loan, your credit score will influence the interest rate you are offered. Those with higher scores generally qualify for lower interest rates, meaning they pay less in interest over the life of the loan. On the other hand, a low score often results in higher interest rates, which means you’ll end up paying more for your borrowing.

For example, if you were to apply for a mortgage, a borrower with a credit score of 720 or higher might secure a 3.5% interest rate, while someone with a score below 600 may face an interest rate of 7% or higher.

Insurance Premiums and Credit Scores

In some cases, your credit score can impact your insurance premiums. Insurers often use credit-based insurance scores, which are similar to regular credit scores but focus more on your risk as an insurance customer. People with higher credit scores often pay lower premiums, while those with lower scores may be charged higher rates.

Job Opportunities

Though not as common, some employers may check your credit score as part of the hiring process, especially for positions that involve financial responsibility. A poor credit score could potentially hurt your chances of securing a job, although employers must get your consent before conducting a credit check.

Improving Your Credit Score

Improving your credit score doesn’t happen overnight, but with time and discipline, you can boost it significantly. Here are some key steps to improve your credit score:

Pay Your Bills on Time

Payment history is the most important factor affecting your credit score, so ensuring that you pay all bills—credit cards, loans, utilities, and even rent—on time is crucial. Set up reminders or automate payments to avoid late fees and negative marks on your credit report.

Keep Your Credit Utilization Low

Try to keep your credit card balances below 30% of your total credit limit. If you’re carrying a balance above this threshold, consider paying down your credit card debt or requesting a credit limit increase to lower your utilization ratio.

For example, if you have a $10,000 credit limit, try not to carry a balance higher than $3,000. If you already do, consider paying down the debt to improve your credit utilization ratio.

Avoid Opening Too Many New Accounts

Every time you open a new credit account, a hard inquiry is made on your credit report, which can temporarily reduce your credit score. Opening multiple new accounts in a short period may signal financial instability, and this can lower your score.

Instead of opening new credit lines, focus on improving the ones you already have by making timely payments and reducing balances.

Review Your Credit Report for Errors

Errors on your credit report can lower your score. If you notice any inaccuracies, dispute them with the credit bureau. Common mistakes might include incorrect late payments or accounts that you’ve already closed but are still reported as open.

By regularly checking your credit report, you can ensure that everything is accurate and correct any discrepancies that may be harming your score.

Consider a Secured Credit Card

If you have a low credit score or no credit history, applying for a secured credit card can help you build or rebuild your credit. A secured credit card requires a deposit, which serves as your credit limit. Use it responsibly, paying your balance in full each month, and your score will improve over time.

Monitoring Your Credit Regularly

To stay on top of your credit, it’s important to monitor your credit score and report regularly. You can request a free credit report from the three major credit bureaus—Equifax, Experian, and TransUnion—once a year at AnnualCreditReport.com. Many financial institutions and credit card companies also offer free credit score monitoring as a service to customers.

By keeping track of your credit score, you can make adjustments as needed and ensure that your credit report is free from errors that could affect your financial health.

Conclusion

Your credit score is a crucial factor in your financial life. It affects your ability to borrow money, the interest rates you’re offered, and even your insurance premiums. Understanding how your credit score is calculated and how it impacts your financial decisions can help you take the necessary steps to improve it.

By paying your bills on time, managing your credit responsibly, and regularly monitoring your score, you can improve your creditworthiness and set yourself up for a stronger financial future.