Introduction to Emergency Funds

An emergency fund is one of the most important components of a healthy financial plan. Life is unpredictable, and unforeseen events such as medical emergencies, car repairs, or unexpected job loss can happen at any time. Without an emergency fund, you may be forced to rely on high-interest debt or borrow from friends or family to cover these expenses, putting you in a financially vulnerable position.

An emergency fund serves as a safety net to help you manage these unexpected financial situations without derailing your financial goals. It gives you peace of mind, knowing that you have money set aside to handle emergencies without needing to go into debt.

In this article, we’ll explore why having an emergency fund is essential and provide practical steps on how to build one.

Why Is an Emergency Fund Important?

Protection from Financial Setbacks

An emergency fund acts as a financial buffer between you and life’s uncertainties. Without one, you might have to rely on credit cards or loans to cover sudden expenses. This can lead to accumulating high-interest debt, which can be difficult to pay off over time and worsen your financial situation.

For example, if your car breaks down unexpectedly and needs costly repairs, your emergency fund can cover the expense without disrupting your budget. Without this safety net, you may be forced to take out a loan, add more debt to your balance, and possibly face high-interest rates.

Reduces Financial Stress

Knowing that you have a cushion to fall back on in times of crisis reduces the anxiety that often accompanies financial uncertainty. Having an emergency fund provides a sense of financial security, which helps alleviate stress during challenging times.

When you don’t have to worry about how you’ll pay for an emergency, you can focus on finding solutions, whether it’s healing from an illness or looking for a new job. Financial stress can take a toll on your overall well-being, and an emergency fund helps shield you from unnecessary hardship.

Helps Avoid Disrupting Financial Goals

Without an emergency fund, you may have to dip into your long-term savings or retirement accounts to cover unexpected expenses. This can derail your financial goals, such as saving for retirement, purchasing a home, or building wealth for the future.

By having an emergency fund, you can ensure that your long-term financial goals remain on track. It gives you the flexibility to manage immediate financial setbacks without compromising your future plans.

Prevents You from Relying on Credit

One of the biggest dangers of not having an emergency fund is the reliance on credit cards or loans to cover unexpected expenses. High-interest debt, especially from credit cards, can quickly spiral out of control and make it harder to recover financially.

With an emergency fund in place, you can avoid relying on credit, which can take years to pay off and cost you significantly more in interest.

How Much Should You Save in an Emergency Fund?

The amount you need in an emergency fund depends on your personal circumstances, including your monthly expenses, job stability, and lifestyle. However, financial experts generally recommend saving between three to six months’ worth of living expenses.

Here’s a simple breakdown to help you determine how much you should save:

- Step 1: Calculate Your Monthly Expenses: Add up all of your monthly expenses, including rent/mortgage, utilities, groceries, transportation, insurance, and other essential costs. This will give you a base amount for your emergency fund.

- Step 2: Multiply by Three to Six Months: Once you know your monthly expenses, multiply the total by three to six months to determine your ideal emergency fund target. For example, if your monthly expenses total $3,000, your emergency fund goal should be between $9,000 and $18,000.

- Step 3: Adjust Based on Your Personal Situation: If you have a stable job and minimal financial obligations, you may be able to get by with a smaller emergency fund. Conversely, if you have a family or an irregular income, you may want to aim for a larger cushion.

Where Should You Keep Your Emergency Fund?

The key to an emergency fund is accessibility. You want to ensure that the money is easy to access when you need it, but it should also be separate from the funds you use for everyday expenses.

High-Yield Savings Accounts

A high-yield savings account is a great option for keeping your emergency fund. These accounts offer higher interest rates than traditional savings accounts, allowing your money to grow over time. Additionally, the funds are easily accessible if an emergency arises.

However, ensure that the account is FDIC-insured to protect your funds up to $250,000. Look for accounts with no maintenance fees and the ability to withdraw or transfer funds easily.

Money Market Accounts

Money market accounts are another option for emergency savings. These accounts typically offer slightly higher interest rates than standard savings accounts and provide easy access to your funds. While the interest rates are often lower than those of high-yield savings accounts, they still offer a relatively safe place to park your emergency fund.

Certificates of Deposit (CDs)

While not ideal for emergencies requiring immediate access, short-term CDs can be a viable option for growing your emergency fund. These accounts lock in your money for a fixed period (e.g., six months or one year) and offer higher interest rates than savings accounts. However, you may face penalties for early withdrawal, so use this option only if you’re confident you won’t need immediate access to the funds.

Avoid Investment Accounts

While you may be tempted to invest your emergency fund in stocks or mutual funds to earn higher returns, this is not recommended. Investments carry the risk of losing money, and the last thing you want is to sell investments at a loss during a financial emergency. It’s best to keep your emergency fund in a low-risk, easily accessible account.

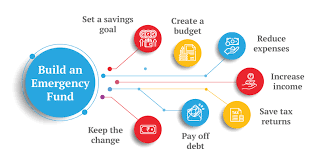

How to Build Your Emergency Fund

Building an emergency fund takes time and discipline, but it’s achievable with a step-by-step plan. Here are some practical tips for building your emergency fund:

1. Start Small and Set a Goal

If you’re just getting started, don’t feel like you need to save three to six months’ worth of expenses all at once. Start with a smaller goal, such as saving $1,000 or $2,000, and gradually increase it as you become more comfortable.

2. Automate Your Savings

Set up automatic transfers to your emergency fund account each payday. Even small contributions add up over time, and automating the process makes it easier to stay on track. Consider transferring 10% of your income until you reach your emergency fund goal.

3. Cut Back on Non-Essential Spending

Review your monthly spending habits and identify areas where you can cut back. Consider reducing discretionary expenses, such as dining out, entertainment, or subscription services, to free up money for your emergency fund. Small adjustments can make a big difference over time.

4. Use Windfalls to Boost Your Fund

If you receive a tax refund, work bonus, or other unexpected windfall, consider putting some or all of it into your emergency fund. This can help you reach your savings goal faster.

5. Track Your Progress

Track your savings progress regularly. Use a budgeting app or spreadsheet to monitor how much you’ve saved and how close you are to your goal. Celebrate milestones along the way to stay motivated.

What to Do Once Your Emergency Fund Is Built

Once you’ve reached your emergency fund goal, continue to contribute to it periodically to keep it up-to-date with inflation and any changes in your living expenses. If you use part of the fund for an emergency, replenish it as soon as possible to ensure it’s available for future needs.

Having an emergency fund in place will give you confidence and peace of mind, knowing that you’re financially prepared for the unexpected.

Conclusion

An emergency fund is an essential component of a solid financial plan. It protects you from the financial shocks of life, reduces stress, and helps you stay on track with your long-term goals. While building an emergency fund takes time, the effort is well worth it for the financial security and peace of mind it provides.