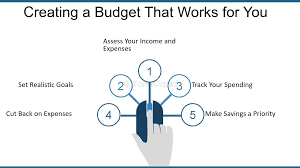

How to Create a Budget That Works for You

Introduction to Budgeting

Creating a budget is one of the most powerful steps you can take toward achieving your financial goals. A budget helps you understand where your money is going, control your spending, and save for both short-term and long-term needs. Whether you’re trying to pay off debt, save for a big purchase, or plan for retirement, a well-structured budget provides the roadmap to make those goals a reality.

However, the idea of creating a budget can feel overwhelming for many people. It requires discipline and a willingness to assess your spending habits. But with the right approach, budgeting can actually simplify your financial life and give you greater control over your money.

In this article, we’ll walk you through the essential steps to create a budget that works for you, focusing on practical tips that will help you stay on track and make adjustments when necessary.

Why Is Budgeting Important?

Before diving into the mechanics of budgeting, it’s important to understand why budgeting is so essential. Here are a few key benefits of having a budget:

1. Provides Control Over Your Finances

A budget gives you control over your income and expenses. Without a budget, it’s easy to overspend or not realize where your money is going. With a budget, you’ll have a clear picture of your financial situation and can prioritize your spending.

2. Helps You Achieve Financial Goals

Whether your goal is to pay off credit card debt, build an emergency fund, or save for a vacation, a budget allows you to allocate your income toward your priorities. Without a budget, you might find it difficult to reach your financial goals, as your spending could undermine your ability to save or invest.

3. Avoids Debt and Improves Savings

A budget helps you live within your means. By tracking your income and expenses, you can identify areas where you can cut back and avoid unnecessary debt. A budget also makes it easier to put aside money for savings and investments, giving you a stronger financial foundation.

4. Provides Financial Awareness

A budget increases financial awareness, making it easier to make informed decisions about your money. It helps you identify where you may be overspending and provides insight into your spending patterns, so you can make better financial choices going forward.

Steps to Create a Budget That Works for You

Step 1: Identify Your Income Sources

The first step in creating a budget is to calculate your total income. This includes not only your salary but also any other sources of income, such as side gigs, freelance work, rental income, or investment dividends.

For example, if your monthly income consists of a salary of $3,500, plus $500 from freelance work, your total monthly income is $4,000.

It’s essential to use your net income—the amount you take home after taxes and other deductions—when budgeting. This ensures you’re budgeting based on the actual amount of money available for spending and saving.

Step 2: List Your Monthly Expenses

Next, list all of your monthly expenses. It’s helpful to categorize these expenses into fixed and variable categories:

Fixed Expenses

These are expenses that stay the same every month, such as:

- Rent or mortgage payments

- Utilities (electricity, water, etc.)

- Loan payments (auto loans, student loans, etc.)

- Insurance premiums

- Subscriptions (e.g., Netflix, gym membership)

Variable Expenses

These expenses can fluctuate from month to month, and may include:

- Groceries

- Gas

- Dining out

- Entertainment

- Clothing

- Personal care (haircuts, toiletries, etc.)

Once you’ve identified your fixed and variable expenses, write them down. If you’re unsure about how much you spend on certain categories, review your bank statements and credit card bills from the past few months to get an accurate picture.

Step 3: Track Your Spending

Tracking your spending is one of the most important steps in creating a budget. You need to understand where your money is going before you can make changes. There are several ways to track your spending:

1. Manual Tracking

You can keep a simple ledger or spreadsheet to track your expenses. This method requires more time and discipline, but it can be effective if you’re comfortable with numbers.

2. Budgeting Apps

There are many apps available to help you track your spending. Popular options like Mint, YNAB (You Need A Budget), or PocketGuard connect to your bank accounts and credit cards, automatically categorizing your expenses. These apps also help you set limits for specific categories, making it easier to stay on track.

3. Bank and Credit Card Statements

Reviewing your bank and credit card statements regularly is another simple way to track your spending. Many banks offer categorization tools, so you can see how much you’ve spent in different categories each month.

Step 4: Set Your Financial Goals

Before you create a budget, it’s important to know what you’re working toward. Set both short-term and long-term financial goals. Short-term goals might include paying off a credit card balance, saving for a vacation, or building an emergency fund. Long-term goals might include saving for retirement, buying a home, or paying off student loans.

When setting goals, make sure they’re specific, measurable, achievable, relevant, and time-bound (SMART goals). For example:

- Short-term goal: Save $500 for an emergency fund within the next three months.

- Long-term goal: Save $20,000 for a down payment on a house in five years.

Step 5: Create a Spending Plan

Once you know your income, expenses, and goals, you can create a spending plan. The idea is to allocate your income toward your essential expenses, savings, and any discretionary spending. Here’s how to approach it:

1. Prioritize Essential Expenses

Make sure to allocate enough money to cover all your fixed expenses (rent, utilities, loan payments, etc.) first. These are non-negotiable and need to be paid in full every month.

2. Allocate for Savings and Debt Repayment

Next, allocate money toward your savings goals (emergency fund, retirement, etc.) and debt repayment. Aim to save at least 10-20% of your monthly income. If you’re carrying high-interest debt, prioritize paying it off first.

3. Budget for Discretionary Spending

After covering your essentials and savings, allocate money for discretionary expenses (dining out, entertainment, shopping). This is where you can make adjustments if you find you’re overspending in certain categories.

Step 6: Review and Adjust Your Budget Regularly

A budget is a living document. Your financial situation will change over time, and your budget should be flexible enough to adapt to those changes. Be sure to review your budget regularly—at least once a month—to ensure you’re staying on track.

If you find you’re consistently overspending in a category, adjust your budget to reflect your actual spending habits. Conversely, if you’re able to save more, consider putting those extra funds toward your financial goals.

Budgeting Tips for Success

Here are a few additional tips to help you succeed in sticking to your budget:

1. Be Realistic with Your Budget

Don’t overestimate how much you can save or underestimate your expenses. If you make your budget too strict, you may find it difficult to stick to. Allow yourself some room for enjoyment, but prioritize savings and essential expenses.

2. Cut Back on Non-Essential Spending

Look for areas where you can cut back. For example, reducing your dining out expenses or canceling unused subscriptions can free up money for your savings goals.

3. Use the 50/30/20 Rule

This rule is a simple guideline for budgeting:

- 50% of your income goes to needs (housing, utilities, groceries, etc.)

- 30% goes to wants (entertainment, dining out, travel, etc.)

- 20% goes to savings and debt repayment.

This rule provides a balanced approach and ensures that you’re saving while still allowing for some discretionary spending.

Conclusion

Creating a budget is one of the most important steps you can take to achieve your financial goals and build a solid foundation for your future. By tracking your income and expenses, setting clear goals, and allocating funds to your priorities, you can take control of your finances and live within your means.

Remember that budgeting is a process, and it’s okay to make adjustments along the way. The key is to stay disciplined and review your budget regularly to ensure you’re on track. With a budget in place, you’ll be well-equipped to handle both planned and unexpected financial challenges, giving you the confidence to make smart financial decisions for years to come.