How to Build a Strong Financial Foundation

Introduction to Financial Foundations

Building a strong financial foundation is the first step toward securing long-term financial success and stability. Just like constructing a solid house, your finances need to be built on a stable base. Without a strong foundation, achieving your financial goals—whether it’s purchasing a home, saving for retirement, or even maintaining day-to-day expenses—becomes a lot harder.

But what does a strong financial foundation look like? It’s the combination of financial literacy, disciplined habits, and strategic decision-making that can help you manage your money efficiently and prepare for unexpected financial events.

In this article, we will break down the essential steps to building a robust financial foundation, from budgeting and saving to investing and retirement planning.

Why Building a Financial Foundation is Essential

Many people think of their financial life as a series of isolated events—getting a loan, saving for a vacation, or paying down credit card debt. However, these events are interconnected, and without a foundational understanding of your finances, managing them can become overwhelming.

A strong financial foundation helps you:

- Minimize financial stress: With proper planning, you’ll be less likely to face unexpected financial burdens.

- Prepare for future goals: You’ll have the tools to save for large purchases, education, and retirement.

- Establish good habits: Healthy financial habits, once formed, become second nature.

- Increase wealth over time: You’ll be able to leverage investments, tax-saving strategies, and smart budgeting to grow your wealth.

The Importance of Financial Literacy

Financial literacy is the key to understanding how to manage your finances. Without it, it’s difficult to make informed decisions about spending, saving, and investing. Financial literacy includes understanding basic concepts like:

- Budgeting: Tracking and managing your income and expenses

- Credit management: How to use credit responsibly and understand credit scores

- Debt management: Knowing how to manage and pay down debt

- Investing: Understanding how to make your money work for you through stocks, bonds, and other investment vehicles

The more knowledgeable you are about your finances, the better equipped you’ll be to make choices that align with your goals and protect your financial well-being.

Key Steps to Build a Strong Financial Foundation

Budgeting: The First Step to Control Your Finances

Budgeting is the cornerstone of any solid financial foundation. Without a clear idea of where your money is going each month, it’s easy to overspend and fall into debt.

Here are the steps to create an effective budget:

- Track Your Income and Expenses: Start by noting down all of your sources of income, whether it’s from your job, side business, or investments. Next, track your monthly expenses—both fixed (rent, utilities, insurance) and variable (food, entertainment, shopping).

- Create a Spending Plan: With this information, allocate a portion of your income to different categories: necessities, savings, debt repayment, and discretionary spending. Make sure that your spending doesn’t exceed your income.

- Stick to Your Budget: Review your budget regularly and adjust as necessary. The goal is to create a system that helps you control spending and save more.

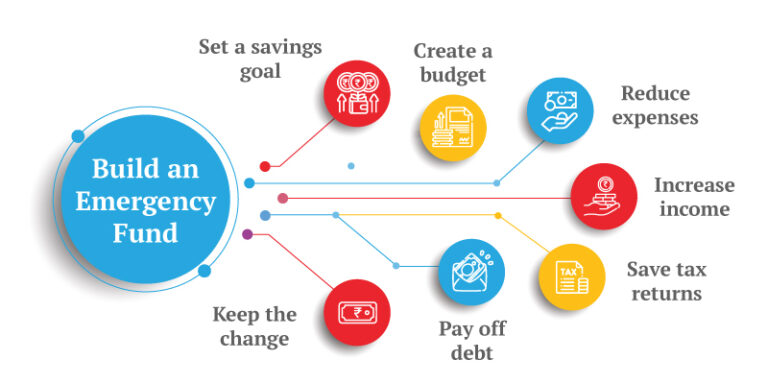

Setting Up an Emergency Fund

An emergency fund is a safety net that protects you from unforeseen expenses, such as medical bills, car repairs, or job loss. Ideally, you should aim to save at least three to six months’ worth of living expenses in an easily accessible account.

To build your emergency fund:

- Start small: If saving a large amount seems daunting, begin with a manageable goal, like $500 or $1,000.

- Automate savings: Set up automatic transfers from your checking account to your savings account to ensure consistent saving.

- Resist the urge to dip into your emergency fund: Only use this money for true emergencies.

An emergency fund ensures that you won’t need to rely on credit cards or loans to cover unexpected costs, protecting your financial stability.

Understanding Credit and Debt Management

Managing credit and debt is crucial to maintaining financial health. Unchecked credit card debt or loans can lead to high-interest payments, financial strain, and poor credit scores. Here’s how to manage credit and debt effectively:

- Pay Your Bills on Time: Timely payments improve your credit score and help avoid late fees and penalties.

- Pay More Than the Minimum: When paying off credit cards or loans, paying more than the minimum balance accelerates the repayment process and reduces interest.

- Understand Your Credit Utilization: Keep your credit card balance below 30% of your credit limit to avoid damaging your credit score.

- Create a Debt Repayment Plan: Use strategies like the debt snowball (paying off the smallest debts first) or the debt avalanche (tackling the highest-interest debts first) to make progress.

Effective debt management prevents debt from overwhelming your finances and enables you to use credit responsibly.

Long-Term Financial Goals

Retirement Planning: Start Early

Planning for retirement should begin as early as possible. The earlier you start saving for retirement, the more time your investments will have to grow, thanks to compound interest.

Here are some steps to take:

- Contribute to Retirement Accounts: Use tax-advantaged retirement accounts like 401(k)s, IRAs, or Roth IRAs to maximize your savings.

- Invest Consistently: Set up automatic contributions to your retirement accounts to ensure consistent growth over time.

- Estimate Your Future Needs: Consider factors like desired lifestyle, healthcare costs, and other potential expenses to determine how much you’ll need to save.

Starting early gives you the best chance of having a financially secure retirement.

Saving for Large Purchases

Large purchases, such as a home or a car, require careful planning and saving. To make these purchases without going into debt, follow these tips:

- Set a Savings Goal: Research the cost of the item you wish to purchase and set a realistic savings target.

- Open a Dedicated Savings Account: Keep the funds for your large purchase separate from your regular savings or emergency fund to avoid spending them accidentally.

- Save Regularly: Automate transfers into your dedicated savings account to keep your plan on track.

Investment Strategies for Beginners

Investing is a powerful way to grow wealth, but it can be intimidating for beginners. Here are some fundamental strategies to help you get started:

- Start Small: You don’t need to invest large amounts right away. Begin with a manageable amount and gradually increase it.

- Diversify Your Portfolio: Spread your investments across different asset classes (stocks, bonds, real estate) to reduce risk.

- Focus on Long-Term Growth: Avoid the temptation to chase short-term gains. Investing for the long term allows you to ride out market fluctuations and benefit from compound growth.

- Use Low-Cost Index Funds or ETFs: These funds offer broad exposure to the market and generally come with lower fees than actively managed funds.

Conclusion

Building a strong financial foundation requires time, patience, and discipline. By budgeting, managing debt, saving for emergencies, and planning for long-term goals, you can create a secure financial future. Remember, the earlier you start building your foundation, the more success you’ll experience in achieving your financial goals.