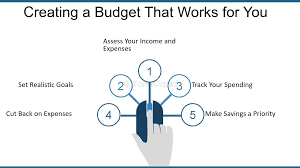

How to Create a Budget That Works for You

Introduction to Budgeting Creating a budget is one of the most powerful steps you can take toward achieving your financial goals. A budget helps you understand where your money is going, control your spending, and save for both short-term and long-term needs. Whether you’re trying to pay off debt, save for a big purchase, or…