The Importance of Emergency Funds: Why You Need One and How to Build It

Introduction to Emergency Funds

An emergency fund is a financial safety net that can help you manage unexpected expenses, such as medical bills, car repairs, or a sudden loss of income. While life is unpredictable, having a well-funded emergency fund can give you peace of mind, reduce financial stress, and prevent you from going into debt when emergencies arise.

In this article, we will discuss the importance of an emergency fund, how much you should aim to save, and step-by-step instructions on how to build your own emergency fund.

Why Is an Emergency Fund Important?

1. Financial Security During Emergencies

Emergencies can happen at any time. Whether it’s a medical emergency, car breakdown, or job loss, these situations can be financially overwhelming. Without an emergency fund, you may have to rely on credit cards or loans, which can lead to debt and added stress. Having an emergency fund allows you to cover unexpected costs without derailing your financial plan.

2. Peace of Mind

Knowing that you have funds set aside for emergencies provides peace of mind. Instead of stressing about how to pay for unexpected expenses, you can confidently handle the situation, knowing you have financial resources available.

3. Protecting Your Long-Term Goals

Without an emergency fund, you might need to dip into your long-term savings, such as retirement accounts or investment portfolios, to cover emergency expenses. This can hinder your ability to meet your long-term financial goals. An emergency fund allows you to preserve your long-term savings and stay on track toward retirement or other goals.

4. Avoiding Debt

In times of financial crisis, people often turn to credit cards or loans to cover unexpected costs. This can result in high-interest debt, which can take months or even years to pay off. By having an emergency fund, you can avoid accumulating unnecessary debt and the stress that comes with it.

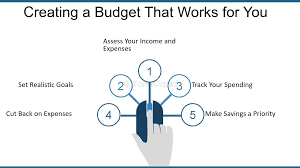

How Much Should You Save in Your Emergency Fund?

The amount you need in your emergency fund depends on your individual circumstances, including your living situation, income, and monthly expenses. However, financial experts recommend that you save enough to cover at least three to six months’ worth of expenses.

Factors to Consider When Determining Your Emergency Fund Goal

- Monthly Expenses: Take a look at your monthly expenses, including rent or mortgage payments, utilities, groceries, insurance, and transportation costs. A good starting point is to calculate your total monthly expenses and multiply that number by three to six months.

- Job Stability: If you work in an industry with high job security or have a steady, predictable income, you may be comfortable with a smaller emergency fund. On the other hand, if you have an unstable job or work as a freelancer, you may want to aim for the higher end of the range to account for periods without income.

- Dependents: If you have dependents, such as children or elderly parents, it’s wise to build a larger emergency fund. This will ensure that you can meet their needs in case of a crisis.

- Health and Insurance: If you don’t have comprehensive health insurance or have medical conditions that may require costly treatments, you may want to set aside extra funds to cover potential healthcare expenses.

General Guidelines for Different Situations

- Single individuals with stable jobs: Aim for three months of expenses.

- Families or households with multiple income sources: Aim for six months of expenses.

- Self-employed or freelancers: Aim for at least six months of expenses due to the potential for income instability.

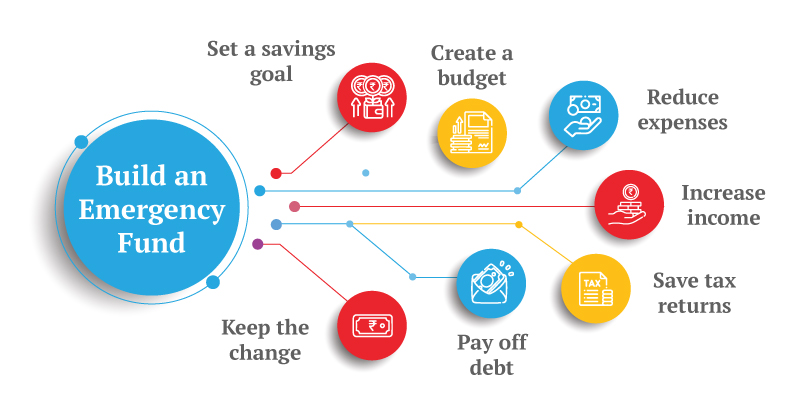

How to Build Your Emergency Fund

Building an emergency fund can seem like a daunting task, but with the right plan and discipline, you can achieve this goal. Here are steps to help you build your emergency fund:

1. Set a Realistic Goal

Start by setting a specific and achievable goal based on your monthly expenses. For example, if your monthly expenses are $2,500, aim to save $7,500 to $15,000 (three to six months of expenses). Setting a goal will keep you motivated and focused on your target.

2. Start Small, But Start Now

Building an emergency fund doesn’t have to be overwhelming. Start with a small, achievable amount, such as $50 or $100 per month. The important thing is to get started and consistently contribute to your fund. As you save more, you’ll build momentum, and it will become easier to increase your contributions.

3. Automate Your Savings

One of the easiest ways to save for an emergency fund is to automate the process. Set up an automatic transfer from your checking account to your emergency savings account each payday. This way, you won’t be tempted to spend the money on non-essentials. By automating your savings, you ensure that you’re consistently contributing to your fund without having to think about it.

4. Reduce Non-Essential Spending

Take a close look at your budget to identify areas where you can cut back. This doesn’t mean you need to deprive yourself, but eliminating or reducing unnecessary spending can free up money to contribute to your emergency fund. Consider cutting back on:

- Dining out

- Subscriptions (streaming services, gym memberships)

- Shopping for non-essential items

- Expensive hobbies or activities

Reallocate the money saved from cutting back on non-essential items to your emergency fund.

5. Use Windfalls Wisely

Whenever you receive extra money—whether it’s a tax refund, work bonus, or a gift—consider using it to boost your emergency fund. These windfalls can provide a significant boost to your savings and help you reach your goal faster.

6. Keep the Fund Separate

To avoid spending your emergency fund on regular expenses, it’s important to keep the money separate from your everyday checking account. Open a separate savings account specifically for your emergency fund, and make sure the account is easily accessible in case of an emergency. Online savings accounts often offer higher interest rates than traditional banks, helping your emergency fund grow faster.

7. Stay Consistent

Consistency is key when building an emergency fund. Even if you can only contribute a small amount each month, sticking to the habit will add up over time. Consider increasing your contributions as your financial situation improves—whether through salary raises, additional income sources, or reducing other expenses.

When Should You Use Your Emergency Fund?

An emergency fund is intended to cover truly unexpected and necessary expenses, such as:

- Medical emergencies: Medical bills, emergency room visits, or unexpected medical treatments.

- Car repairs: Major repairs or breakdowns that prevent you from using your vehicle for work or daily needs.

- Home repairs: Urgent home repairs, such as fixing a broken furnace or replacing a leaky roof.

- Job loss: If you lose your job or face a period of unemployment, your emergency fund can help cover living expenses while you search for new employment.

It’s important to resist the temptation to dip into your emergency fund for non-emergency expenses. If you use it for discretionary items or purchases, you may find yourself without the necessary resources when a real emergency occurs.

How to Maintain Your Emergency Fund

Once you’ve built your emergency fund, it’s important to maintain it:

- Replenish your emergency fund: If you do need to use your emergency fund, make it a priority to rebuild it as soon as possible.

- Review periodically: Regularly assess your emergency fund to ensure it’s still aligned with your current expenses and financial situation. Increase your goal if necessary due to changes in income, living situation, or family size.

Conclusion

An emergency fund is one of the most important financial tools you can have to protect yourself from unexpected expenses and financial stress. By setting clear goals, saving consistently, and building a fund that can cover three to six months of expenses, you’ll be prepared for whatever life throws your way. Remember, it’s not about saving the entire amount overnight—it’s about making steady progress and building a buffer for your financial future.

Start today, and over time, you’ll create a strong safety net that gives you peace of mind and keeps you on track toward financial stability.

Let me know if you’d like to proceed with more articles or need anything else!